Introduction

Getting rich by investing is not easy, but it is possible. It requires discipline, patience, and a willingness to learn. If you are willing to put in the work, you can achieve your financial goals and build a future of wealth and security. If you are a beginner and you want to invest in the stock market, I have made a Rupees 1 lakh portfolio below.

Table of Contents

ToggleIf you want to become rich and want to spend a wealthy life, you must understand the concept of compounding.

The Power of Compound Interest

One of the most important concepts in investing is compound interest. Compound interest is when your earnings start to earn their own earnings. This can create a snowball effect, where your money grows exponentially over time.

To illustrate the power of compound interest, consider the following example:

- You invest $10,000 at a 7% annual return.

- After 10 years, your investment will have grown to $25,937.

- After 20 years, your investment will have grown to $61,917.

- After 30 years, your investment will have grown to $143,707.

As you can see, compound interest can have a significant impact on your wealth over time. The earlier you start investing, the more time your money has to compound and grow.

Diversification

One of the most important principles of investing is diversification. Diversification means spreading your money across different types of investments. This helps to reduce your risk if one investment performs poorly.

For example, if you have all of your money invested in stocks and the stock market crashes, you could lose a significant amount of money. However, if you have your money diversified across stocks, bonds, and real estate, you will be less likely to lose everything.

Asset Allocation

Asset allocation is the process of determining how much of your money to invest in each asset class (stocks, bonds, real estate, etc.). Your asset allocation should be based on your risk tolerance, time horizon, and financial goals.

If you are young and have a long time horizon, you can afford to take on more risk. This means that you may want to allocate a larger portion of your portfolio to stocks. However, if you are older and closer to retirement, you may want to allocate a larger portion of your portfolio to bonds and other less risky investments.

Rupees 1 lakh portfolio

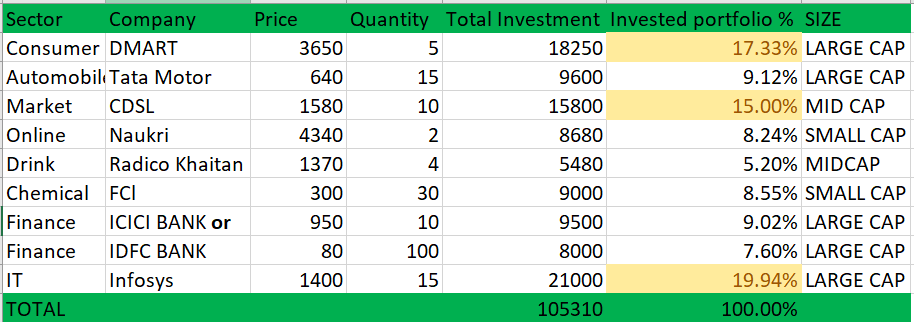

I have made a portfolio of rupees 1 lakh, where I have created a bunch of 9/10 stock. It should be kept in mind that every person has different risk factors. As per analysis, 87% of people want medium risk, high growth. Keeping that in mind, I have added the below stocks.

In the above portfolio of 1 lakh, I have diversified the stock in different sectors. The above stocks are defensive and growth stocks as well. If you are thinking of creating a Rupees 1 lakh portfolio, you can consider the above stocks.

Rebalancing

Once you have created an asset allocation plan, it is important to rebalance your portfolio regularly. This means selling some of your winners and buying more of your losers to maintain your desired asset allocation.

Rebalancing is important because it helps to reduce your risk and keep your portfolio on track to meet your financial goals.

Conclusion

Becoming rich by investing is not easy, but it is possible. By following the tips above, you can increase your chances of success. Just remember to be patient, disciplined, and willing to learn.

Additional Tips for Success

Here are some additional tips to help you become rich by investing:

- Start early: The earlier you start investing, the more time your money has to grow.

- Invest regularly: Even if you can only invest a small amount each month, it will add up over time.

- Don’t panic sell: It is normal for the stock market to go up and down. Don’t sell your investments just because the market is down in the short term.

- Get professional help: If you are not sure how to invest, consider working with a financial advisor. A financial advisor can help you create a personalized investment plan and choose the right investments for your needs.

- Invest for the long term: One of the most important keys to success in investing is to invest for the long term. This means not trying to time the market or make quick profits. Instead, focus on investing in high-quality assets that you believe have the potential to grow over time.When you invest for the long term, you are more likely to ride out market downturns and achieve your financial goals.

- Be patient and disciplined: Investing is a marathon, not a sprint. It takes time and discipline to build wealth through investing.

Don’t get discouraged if you don’t see results immediately. Just keep investing regularly and reinvesting your earnings, and over time your money will grow.

Investing can be a complex and challenging topic. However, by following the tips above, you can increase your chances of success and achieve your financial goals.

Also, you should know this that there are 2 main stocks exchange in India and they are NSE and BSE

TAGS

1 lakh portfolio stocks |

1 lakh portfolio investing |

1 lakh portfolio example |

1 lakh portfolio stocks in India |

1 lakh portfolio companies |

best 1 lakh portfolio stocks |

Best Portfolio Stocks 2023 India |

Invest 1 lakh and get 15000 per month |

Also, you can read

Top 30 premium Credit Cards in India

Features and Benefits of Axis Bank Magnus Credit Card

3 thoughts on “How to Become Rich by investing |Rupees 1 lakh portfolio”