Tata Technologies IPO is a book- value issue of Rs 3,042.51 crores. The issue is entirely an offer for the sale of 6.09 crore shares. Tata Technologies IPO opens for subscription on November 22, 2023, and closes on November 24, 2023. The allotment for the Tata Technologies IPO is anticipated to be perfected on Thursday, November 30, 2023. Tata Technologies IPO will be listed on BSE, NSE with a conditional table date fixed as Tuesday, December 5, 2023. Tata Technologies IPO price band is set at ₹ 475 to ₹ 500 per share.

The minimal lot size for an operation is 30 Shares. The minimal quantum of investment needed by retail investors is ₹ 15,000.

The minimal lot size investment for sHNI is 14 lots( 420 shares), amounting to ₹ 210,000, and for bHNI, it’s 67 lots( 2,010 shares), amounting to ₹ ₹1,005,000.

About Tata Technologies IPO

Incorporated in 1989, Tata Technologies is a leading global engineering services and digital services company that specializes in providing innovative solutions to the automotive, aerospace, and industrial sectors.

Tata Technologies is a subsidiary of Tata Motors. This is an IPO from a Tata group company after a span of 19 years, following the successful Tata Consultancy Services (TCS) IPO in June 2004. The Pune-based company specializes in providing outsourced engineering services and driving digital transformations for clients worldwide. They have a workforce of over 11,000 employees spread across 18 global delivery centers.

The company’s core focus lies in assisting companies throughout the entire product development process, from conception and design to development and delivery, ultimately enabling the creation of superior products. Tata Motors and Jaguar Land Rover (JLR) are among the top five clients of Tata Technologies. It also counts VinFast, a Southeast Asian EV OEM, among its most important clients.

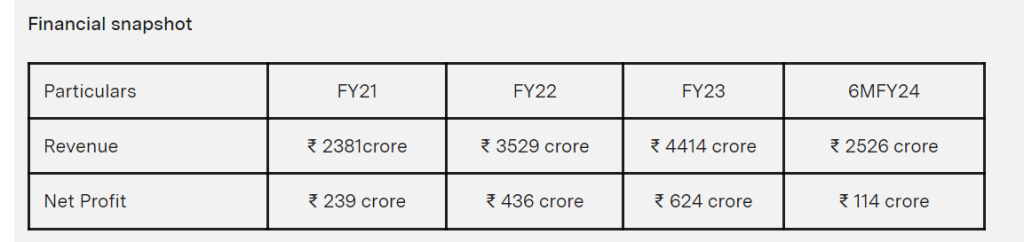

The company saw a CAGR rise of over 22% in its revenue from operations and over 37% in its profit between FY21 and FY23. Moreover, the global engineering, research, and development (ER&D) spending is expected to reach $2.67 trillion by 2026 from $1.81 trillion as of 2022. Out of these, ER&D spending outsourced to third-party service providers is anticipated to grow at a CAGR of 11-13% between 2022 and 2026. All this could be beneficial for the company.

This company is now launching the Tata Technologies Ltd IPO. The Tata Technologies IPO will be a complete offer for sale where existing shareholders and promoters will offload over 9.57 crore shares. Meanwhile, the company shares will be listed on the NSE and BSE.

Source: Upstox(Tata Technology IPO)

Tata Technology IPO Key factor

| Company Name | Tata Technology Limited |

| Company Type | Private |

| Company Established | 1994 |

| Tata Technology IPO Opening Date | 22-Nov-23 |

| Tata Technology IPO Closing Date | 24-Nov-23 |

| Tata Technology IPO Allotment Status | 30-Nov-23 |

| Credit of Share in Demat | 4-Dec-23 |

| Tata Technology IPO Listing Date | 5-Dec-23 |

| Tata Technology IPO Face Value | 2 per share |

| Tata Technology IPO Lot Size | 30 shares |

| Tata Technology IPO Issue Size | 3042.51 cr |

| Tata Technology IPO Listing | BSE, NSE |

| Tata Technology Price Band | 475- 500 per share |

| Tata Technology quota for Tata Motor | 15% |

Tata Technology IPO Financial

Tata Technology PE / Market Cap

| P/E | 32.53 |

| Sector P/E | 38 |

| Market Cap (in Cr) | 20283 |

| EPS | 15.37 |

Tata Technology IPO GMP

Now let us see the most important part of the IPO, which is What is the GMP of Tata Technology. I would suggest you bookmark this page as I will be going to update the below Tata Technology GMP daily

What is Tata Technologies IPO GMP Today?

What is Tata Technologies IPO Kostak Rates Today?

The Tata Technologies IPO Kostak Rate is ₹-.

What is Tata Technologies IPO Subject to Sauda Price Today?

The Tata Technologies IPO subject to sauda rates is ₹-.

Tata Technologies IPO Expected Returns?

The Tata Technologies expected return is 70%.

Should I apply to Tata technology IPO or not?

My Answer to this is YES. As the name ‘TATA’ itself suggests it has a good promotor and the scope for the long term in this IPO is also good. So you can definitely go for this IPO, whether for listing gain or for the long term.

If you want a long-term portfolio of 1 lakh you should check : 1 lakh rupees portfolio

Tags

- Tata Technology IPO

- Tata Tech IPO listing date

- Tata Tech IPO

- Tata Technology GMP

- Tata Tech IPO GMP

- What is the grey market price of Tata technology

- Tata Technology GMP today

- GMP Tata tech

Read about the Top 19 Millionaire habits

One thought on “Tata Technologies IPO and GMP Details | Should you apply or not?”